41 ytm for coupon bond

Understanding the Yield to Maturity (YTM) Formula | SoFi By using this formula, the estimated yield to maturity would calculate as follows: The Importance of Yield to Maturity. Knowing a bond's YTM can help investors compare bonds with various maturity and coupon rates. For example, consider two bonds of varying maturity: a five-year bond with a 3% YTM and a 10-year bond with a 2.5% YTM. How do you calculate yield to maturity on a callable bond? The Yield to maturity is the internal rate of return earned by an investor who bought the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule. Yield to maturity (YTM) = [(Face value/Present value)1/Time period]-1.

Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

Ytm for coupon bond

Calculate YTM on deferred coupon bonds using texas instruments Regular annual coupon payments at a rate of 8% will then be made until the bonds mature at the end of 10 years. If the bonds are currently priced at $87.00, their yield to maturity is closest to: 6% = Answer. The yield to maturity (r) is computed by solving for r in the following equation: 87.00 = 8/ (1 + r) 5 + 8/ (1 + r) 6 + 8/ (1 + r) 7 + 8 ... The Difference Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market.

Ytm for coupon bond. Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. How is YTM related to coupon rate? - Skinscanapp.com The yield to maturity for zero-coupon bonds is also known as the spot rate. When the coupon rate on a bond is equal to the yield to maturity the price of the bond will be? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is calculated as: Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to... Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

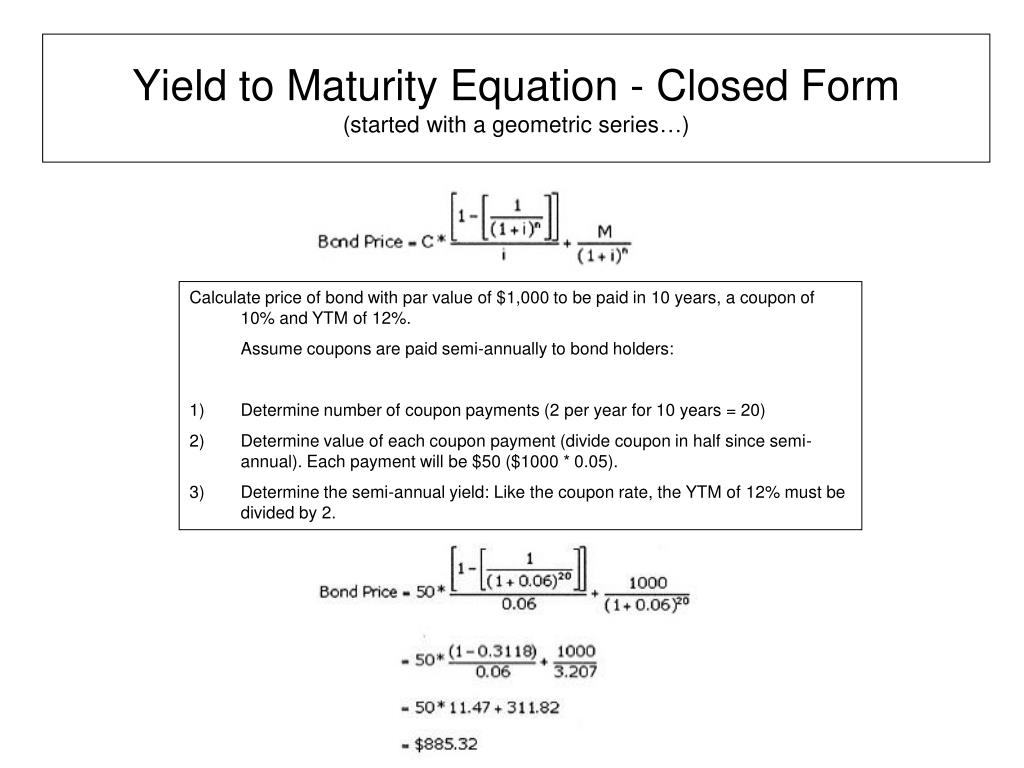

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Below is the YTM formula Where, bond price = the current price of the bond. Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer. YTM = the discount rate at which all the present value of bond future cash flows equals its current price. Treasuries - WSJ We are in the process of updating our Market Data experience and we want to hear from you. Please send us your feedback via our Customer Center How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

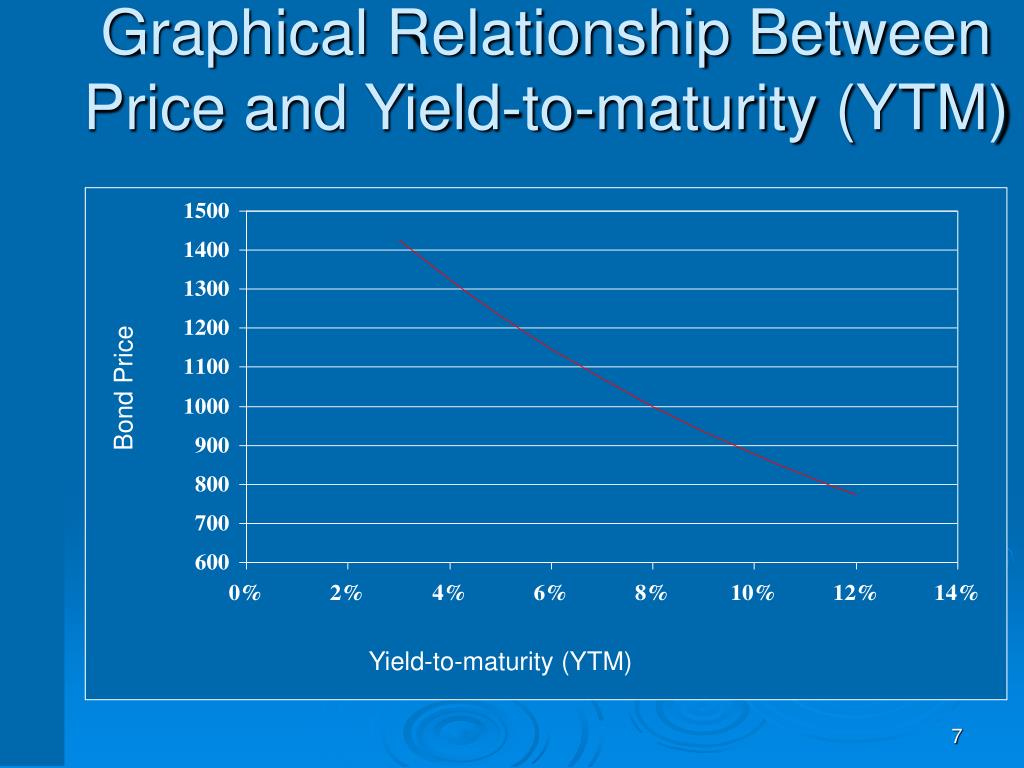

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate - Meaning, Calculation and Importance - Scripbox This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. ... Purchase Price of a Bond: Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face value (at a premium) 15%: Lower than the coupon rate: Yield to Maturity (YTM) Definition - Investopedia To calculate YTM here, the cash flows must be determined first. Every six months (semi-annually), the bondholder would receive a coupon payment of (5% x $100)/2 = $2.50. In total, they would... YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India - The Fixed Income This will drive down the YTM on the existing bonds to 7.0%, while the market price of the existing bonds will increase to ₹103.30 as they will be more attractive for investing, making them trade at a premium. YTM, market price, and the coupon rate of a bond are all either inversely or directly related. Underlying driver for a movement in ...

Current Yield vs. Yield to Maturity - Investopedia For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments....

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Yield to Maturity (YTM): Formula and Excel Calculator - Wall Street Prep Annual Coupon (C) = 3.0% × $1,000 = $30 Yield to Maturity (YTM) Example Calculation With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM). Semi-Annual Yield-to-Maturity (YTM) = [$30 + ($1,000 - $1,050) / 20] / [ ($1,000 + $1,050) / 2] Semi-Annual YTM = 2.7%

How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · The bond provides coupons annually and pays a coupon amount of 0.025 x 1000= $25. Notice here that "Pmt" = $25 in the Function Arguments Box. The present value of such a bond results in an outflow ...

The Returns on a Bond - YTM - The Fixed Income The bond price is calculated from the yield to maturity of the bond, as that is the effective return on the bond. The formula, YTM = C1/ (1+YTM)^1 + C2/ (1+YTM)^2 + C3/ (1+YTM)^3 + ……+ Cn/ (1+YTM)^n + Maturity value/ (1+YTM)^n Here 'C' is the coupon or each installment of interest received,

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate.

Post a Comment for "41 ytm for coupon bond"