39 current yield coupon rate

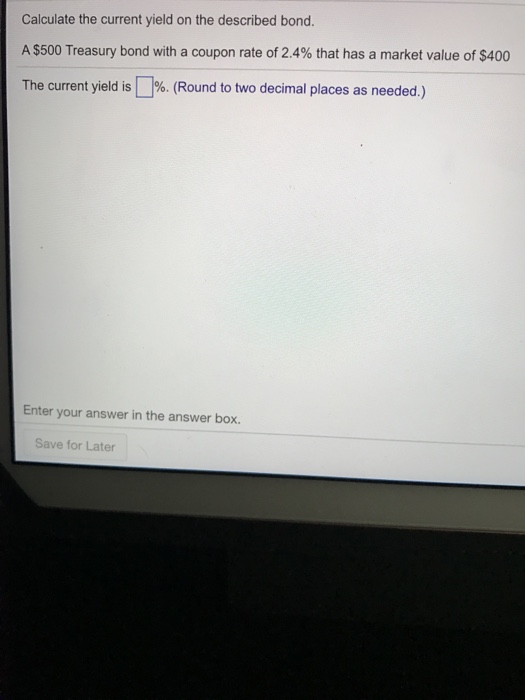

Example of - zgk.attractivehouse.fr Yield to Maturity: % Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield. Compound Interest Present Value Return Rate / CAGR Annuity Pres. Val. of. ... In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Yield to Maturity Calculator | Good Calculators CR is the coupon rate. Example 1: What is the current yield of a bond with the following characteristics: an annual coupon rate of 7%, five years until maturity, and a price of $800? Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100. CY = 8.75%, The Current Yield is 8.75%

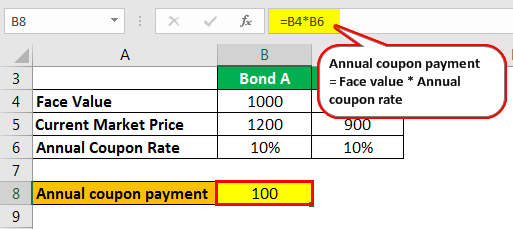

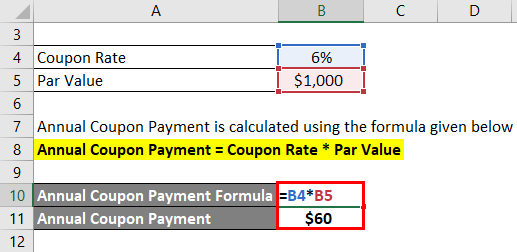

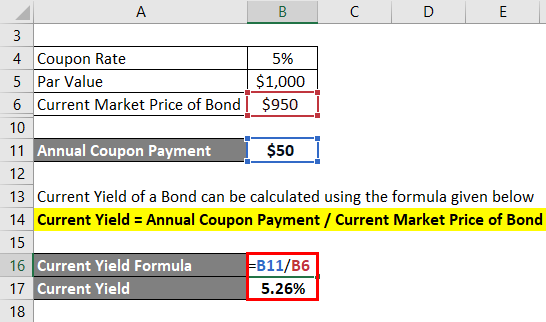

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Annual Coupon Payment = Coupon Rate * Par Value Annual Coupon Payment = 5% * $1,000 Annual Coupon Payment = $50 Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $50 / $950 Current Yield = 5.26%

Current yield coupon rate

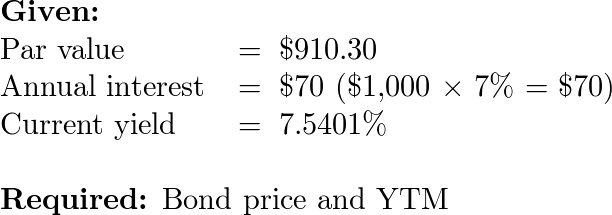

Coupon Rate: Formula and Bond Yield Calculator [Excel Template] Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ... Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate? Current Yield: Bond Formula and Calculator [Excel Template] Current Yield Formula Current Yield = Annual Coupon ÷ Bond Price For instance, if a corporate bond with a $1,000 face value ( FV) and an $80 annual coupon payment is trading at $970, then its current yield equals 8.25%. Current Yield = $80 Annual Coupon ÷ $970 Bond Price Current Yield = 8.25% Current Yield of Discount, Par & Premium Bonds

Current yield coupon rate. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the face value and the market value of the bond and their... Current Yield vs. Yield to Maturity - Investopedia For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is...

Yield to Maturity vs. Coupon Rate: What's the Difference? The annual coupon rate for IBM bond is thus $20 / $1,000 or 2%. Fixed-Rate and Market Value While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the bond... Current Coupon Definition - Investopedia A current coupon refers to a bond that trades close to its par value when it was first issued. Bonds that sell at a yield that is within ±0.5% of current market interest rates are said to have a... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as such, … Coupon Rate Vs Current Yield Vs Yield To Maturity Ytm Explained With ... Ppt Interest Rates And Bond Valuation Powerpoint Presentation Id 242353. Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). if you plan on buying a new issue bond and holding it to maturity, you only need to pay attention to the coupon rate. if you bought a bond at a discount, however, the yield to maturity will be higher than ...

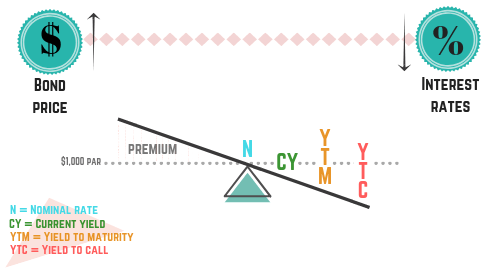

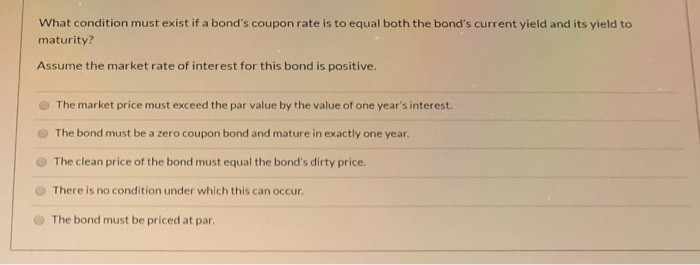

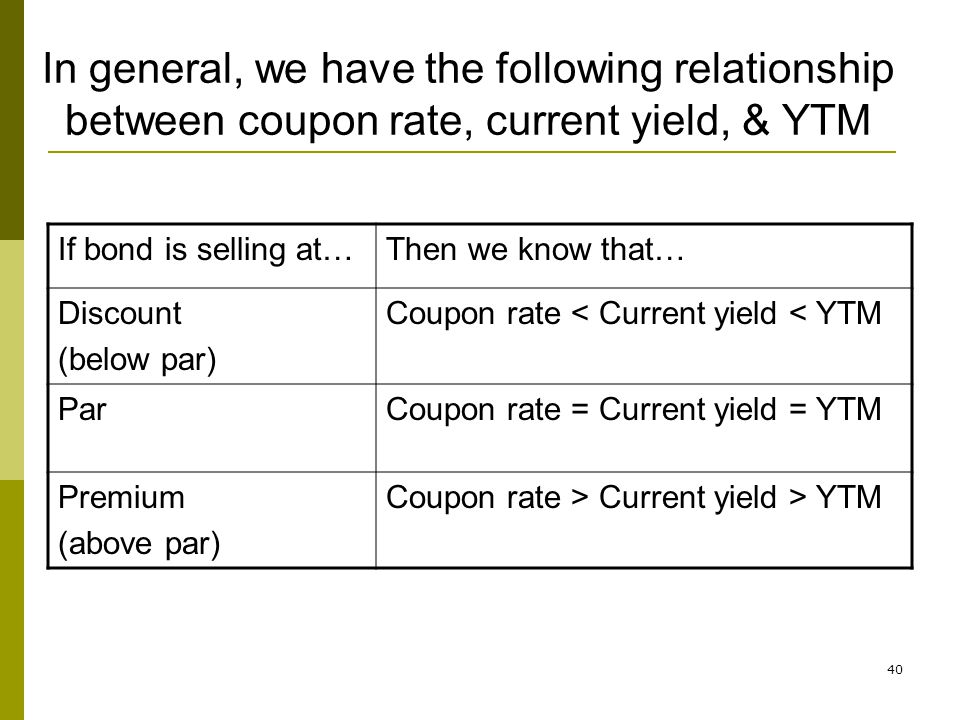

Current Yield - Relationship Between Yield To Maturity and Coupon Rate ... The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. When a bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. Current Yield = Total Yield - Capital Gains Yield Coupon rate and current yield | Mint So if a bond with a face value of ₹ 100 and 10.5% coupon is currently trading at ₹ 103, then the current yield is 10.19%. Bond yield and prices have an inverse relationship—when prices rise ... Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. Bond Yield Calculator - CalculateStuff.com Let’s take a look at an example below to understand how to calculate current yield as well as YTM. Example. We can start with the current yield calculation, as that will be a much easier task. To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. The bond pays out $21 every six months ...

Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it!

Current yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. = = $ % $ = $ $ = % Shortcomings of current yield. The current yield refers only to the yield of the bond at the current moment.

Current Yield of a Bond - Meaning, Formula, How to Calculate? The reason why current yield fluctuates and deviates from the annual coupon rate is because of the changes in interest rate market dynamics based on Inflation expectations of the investors. Current yield, when used with other measures such as YTM, Yield to the first call, etc. helps the investor in making the well-informed investment decision.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs . Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments). Macaulay Duration (Years) - Weighted average time (in years) for a payout from the …

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) Calculator. Algebra Civil Computing Converter Demography Education Finance Food Geometry Health Medical Science Sports Statistics. Formulas; ... Capital Gains Yield Capitalization Rate Cash To Current Liabilities Current Ratio Economic ...

Bond Yield Calculator - Compute the Current Yield - DQYDJ The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity

Current Yield Formula (with Calculator) - finance formulas The formula for current yield only looks at the current price and one year coupons. Example of the Current Yield Formula. An example of the current yield formula would be a bond that was issued at $1,000 that has an aggregate annual coupon of $100. The bond yield on this particular bond would be 10%.

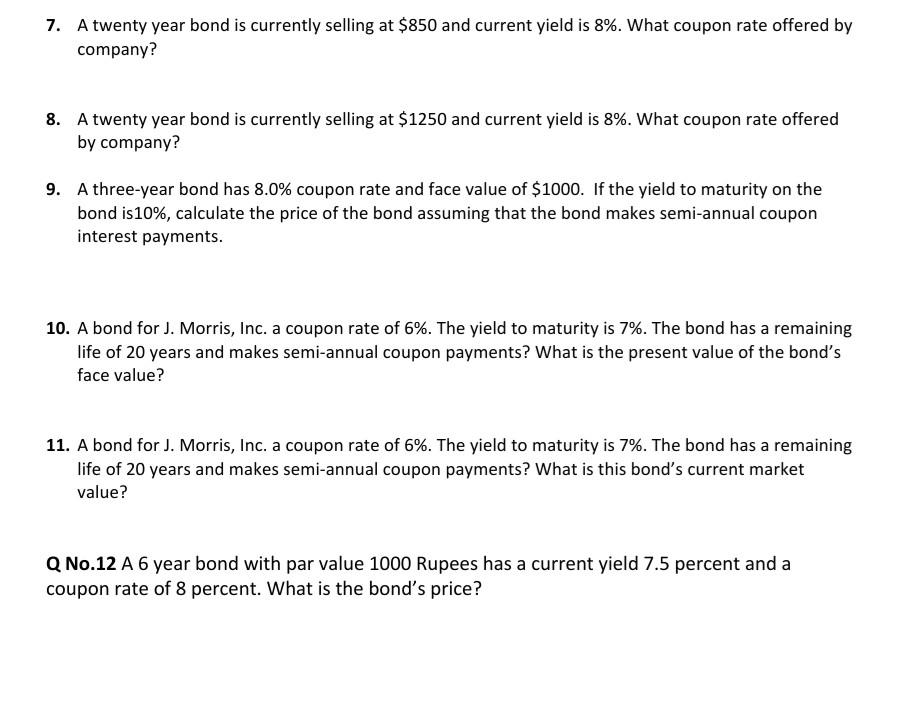

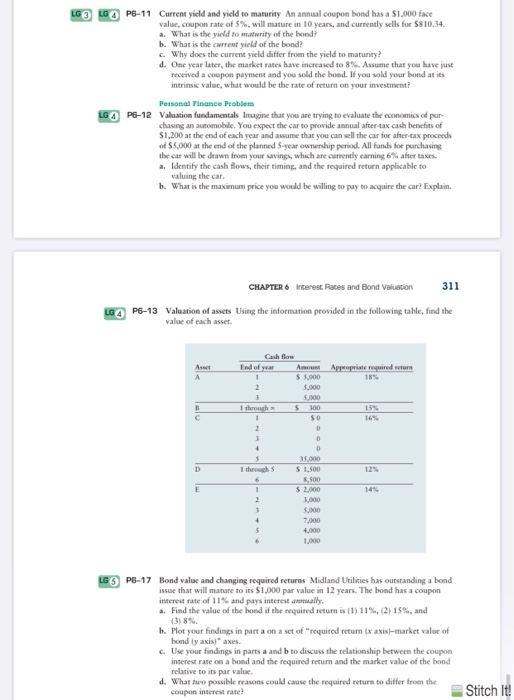

Determine Coupon Rate, Current Yield, and Yield to Maturity - BrainMass The Garland Corporation has a $1,000 par value bond outstanding with a $90 annual interest payment, a market price of $820 and a maturity date in five years. Find the following: a. The coupon rate. b. The current yield. c.

What Are Coupon and Current Bond Yield All About? - dummies The coupon yield, or the coupon rate, is part of the bond offering. A $1,000 bond with a coupon yield of 5 percent is going to pay $50 a year. A $1,000 bond with a coupon yield of 7 percent is going to pay $70 a year. Usually, the $50 or $70 or whatever will be paid out twice a year on an individual bond.

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Current Yield (%): Simple yield based upon current trading price and face value of the bond. ... Annual Coupon Rate: 10%; Coupon Frequency: 2x a Year; 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25%. What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find …

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Current Yield - Investopedia 30.10.2020 · Current yield is an investment's annual income (interest or dividends) divided by the current price of the security. This measure looks at the current price of a bond instead of its face value ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Current Yield: Bond Formula and Calculator [Excel Template] Current Yield Formula Current Yield = Annual Coupon ÷ Bond Price For instance, if a corporate bond with a $1,000 face value ( FV) and an $80 annual coupon payment is trading at $970, then its current yield equals 8.25%. Current Yield = $80 Annual Coupon ÷ $970 Bond Price Current Yield = 8.25% Current Yield of Discount, Par & Premium Bonds

Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate?

Coupon Rate: Formula and Bond Yield Calculator [Excel Template] Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

![Current Yield: Bond Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/31231559/Current-Yield-Calculator-scaled.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "39 current yield coupon rate"