38 are zero coupon bonds taxable

Municipal Bonds vs. Taxable Bonds and CDs - Investopedia Jan 31, 2022 · If you sit in the 35% income tax bracket and live in a state with relatively high income tax rates, investing in municipal bonds (munis, for short) will likely be a better option than taxable ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

The EU Mission for the Support of Palestinian Police and Rule ... Oct 14, 2022 · EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ...

Are zero coupon bonds taxable

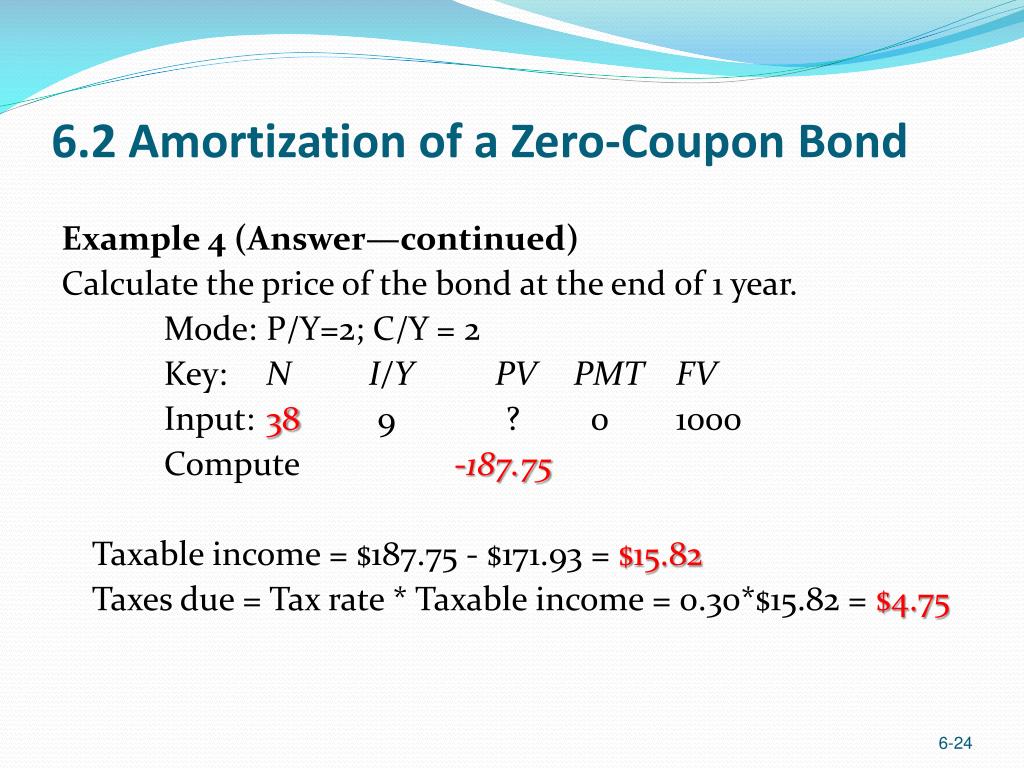

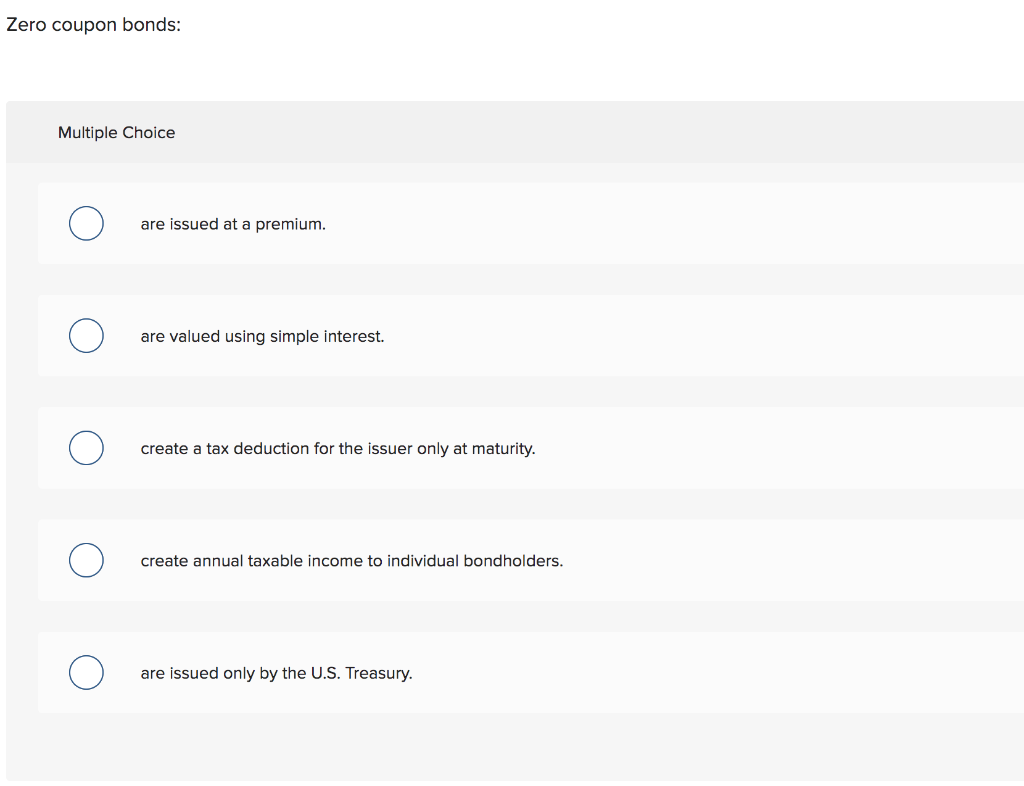

DIY Seo Software - Locustware.com A.I. Advanced A.I. Content Writer $ 247 Our private A.I. tool requires no monthly subscription. Over 500,000 Words Free; The same A.I. Engine as all of the big players - But without the insane monthly fees and word limits. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later.

Are zero coupon bonds taxable. Taxation Rules for Bond Investors Jan 31, 2021 · Taxation of Zero-Coupon Bonds . Although they have no stated coupon rate, zero-coupon investors must report a pro-rated portion of interest each year, as income, even though interest hasn’t been ... Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data DIY Seo Software - Locustware.com A.I. Advanced A.I. Content Writer $ 247 Our private A.I. tool requires no monthly subscription. Over 500,000 Words Free; The same A.I. Engine as all of the big players - But without the insane monthly fees and word limits.

Post a Comment for "38 are zero coupon bonds taxable"