40 coupon rate and yield

What is the relationship between coupon rate required yield and price ... When is the yield to maturity equals the coupon rate? When a Bond's Yield to Maturity Equals Its Coupon Rate. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. Nov 18 2019 Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Coupon rate and yield

Coupon rate and current yield | Mint So if a bond with a face value of ₹ 100 and 10.5% coupon is currently trading at ₹ 103, then the current yield is 10.19%. Bond yield and prices have an inverse relationship—when prices rise ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal. Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

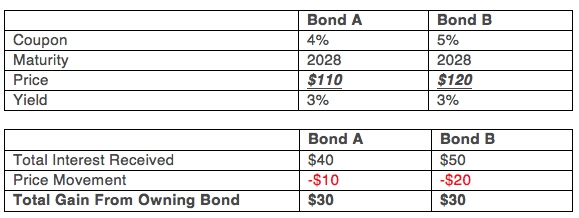

Coupon rate and yield. What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... Yield to Maturity (YTM) – This is the total return investors earn when they hold the bond until it matures. Like the coupon or nominal yield, ... Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although... Comparison: Coupon Rate vs Yield for a Bond - Easy Peasy Finance The coupon rate is fixed and is not dependent on the price of the bond. If the current market price of the bond is less than the par value, then, the yield will ... Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between Current Yield and Coupon Rate The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. In contrast, the coupon rate is a fixed interest paid by the issuer annually on the face value of a bond. Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The Coupon Rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. What is the difference between Coupon Rate and Yield to Maturity ... The yield would fluctuate inversely with the bond's market price. Yield formula. Let consider three scenarios. Scenario -1. Coupon rate = (10000 * 10) / 100 = 1000 (Interest Payment) Scenario -2. If the bond price is selling in discount price either because of the market fluctuation or the bond hold is willing to sell of due his emergencies ... Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%.

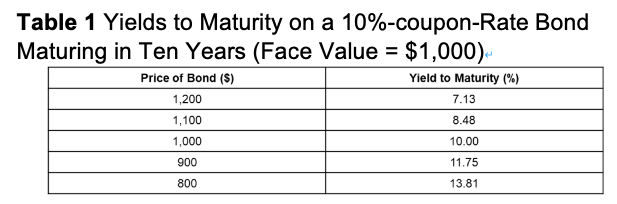

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... Solved a. Calculate the yield to matunty (YTM) for the bond | Chegg.com Explain a. The yield to maturity (YTM) for the bond is 16. (Round to two decimal places) Question: a. Calculate the yield to matunty (YTM) for the bond b. What rolationship oxists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain a. The yield to maturity (YTM) for the bond is 16. Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Coupon Rate Calculator | Bond Coupon What is the difference between bond coupon rate and yield to maturity (YTM)? As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond. It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%....

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value

What is the difference between coupon and yield? Bond Price = Coupon Rate / (1 + YTM)^n + Par Value / (1+YTM)^n This formula shows that the relationship between coupon rate and yield is inverse. If coupon rates increase, then the price...

Difference Between a Coupon Rate and a Yield Rate? Coupon rates and yield rates are both calculated using the interest rate and the face value of the bond. The coupon rate is the interest rate paid on the bond, while the yield rate is a bit more complex. The yield rate takes into account the interest rate paid on the bond and any capital gains or losses that may occur when the bond is sold.

Bond Coupon Interest Rate: How It Affects Price - Investopedia At $715, the bond's yield is competitive. Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to rise in price. If the general interest rate is 3%...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Rec Limited - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment ...

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

When is a bond's coupon rate and yield to maturity the same? - Investopedia The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face...

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Difference between Coupon Rate And Yield To Maturity - Angel One The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to ...

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal. Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time.

Coupon rate and current yield | Mint So if a bond with a face value of ₹ 100 and 10.5% coupon is currently trading at ₹ 103, then the current yield is 10.19%. Bond yield and prices have an inverse relationship—when prices rise ...

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "40 coupon rate and yield"